Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

IRS audit.

These two words can strike fear in anyone in an instant.

Luckily, there’s good news. IRS audits are rare. But you still need to be aware of what triggers an IRS audit — and what to expect if the IRS comes knocking at your door.

While the risk of an audit is less than 1% for most people, there are some things that you can do to lower that risk even more. Keep reading to find out how.

How Far Back Can the IRS Audit?

In most situations, an IRS audit can go back three years.

But the IRS does try to notify you of an audit as soon as they can after a return is filed, so most audits will take place within two years after filing. There are some situations where the IRS can go back even further, but in most cases, they’ll only be allowed to go back three years.

If you’re selected for an audit, you’ll be notified via mail.

But, if you understand what an IRS audit is, and avoid IRS triggers, you don’t have to ask the question “how far back can the IRS audit?”

Keep reading to find out IRS audit triggers — and why an audit may not be as bad as it sounds.

What Is An IRS Audit?

Every year you (hopefully) file your tax return. Occasionally, after you file, the IRS wants to take a second look at something. The process of taking another look at your taxes is called an audit.

An audit doesn’t necessarily mean that you’ve done something wrong. The IRS simply wants to be sure that everything reported on your tax return complies with laws and regulations.

While an audit may end with you needing to pay additional money, it also could end with the government giving you money back.

In 2020, almost 19,000 audits resulted in the IRS issuing an additional refund to the taxpayer. So, contrary to public belief, an IRS audit isn’t always bad news.

Red Flags That Will Trigger An Audit

While the idea of an audit is scary, it’s important to remember that the odds of being selected for an audit are low. In 2018 the IRS audited 1 million tax returns. That sounds like a lot but in reality, it’s only 0.5% of the returns that were filed.

So overall, you have low chances of being selected for an audit. But there are some things that may cause the IRS to want to take a second look at your books.

Some of these things include:

No Income Or High Income

The IRS publishes data on who they audit each year. One of the ways they share this is by detailing the percentage of audits they do broken down by income level.

In 2020 the IRS audited nearly 450,000 tax returns. That sounds like a lot but in reality, it’s only 0.29% of the returns that were filed.

So overall, you have low chances of being selected for an audit. But there are some things that may cause the IRS to want to take a second look at your books.

Some of these things include:

No Income Or High Income

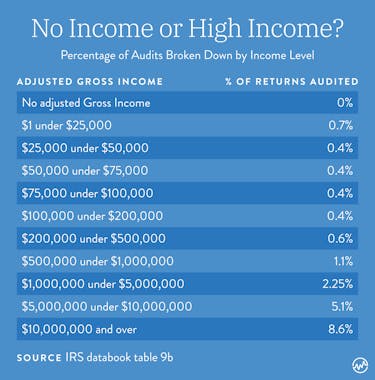

The IRS publishes data on who they audit each year, and it’s clear that income level matters significantly when it comes to who they choose to audit.

In 2020, IRS audits of millionaires dramatically decreased by a whopping 72%.

Rather than focusing on individuals who make hefty incomes, the IRS has shifted their focus on individuals who claim to have no adjusted income at all.

If your income level falls somewhere in the middle, then you’re among the group that’s the least likely to endure an audit.

For example, in 2020 they audited 8.6% of the returns that were filed with an adjusted gross income of over $10,000,000 and 8.9% of returns with no adjusted gross income.

Remember, they only audited 0.29% of all returns, so by auditing nearly 9% of returns in these two extreme income categories, it shows they are focusing on returns with a high reported income or no adjusted gross income.

Source: IRS databook table 9b

Filing Schedule C

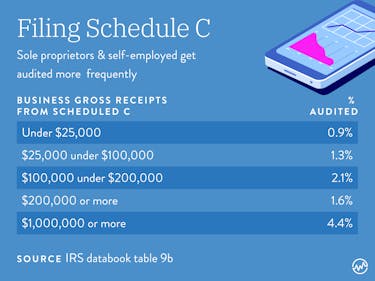

If you run a business as a sole proprietor and file a Schedule C, the odds of being selected for an audit increase. This may be because the IRS sees that there are more opportunities for business owners to take deductions that potentially aren’t justified.

That doesn’t mean you shouldn’t start your business. Just keep this as a reminder that self-employed get audited more frequently — another reason to keep your books in tip-top shapes.

Source: IRS databook table 9A

Unusually High Deductions

Another item that can cause the IRS to take a second look at your tax return — unusually high deductions.

A tax deduction is something that lowers your taxable income, which will lower the amount you have to pay in taxes. The IRS knows that individuals and business owners are going to use tax deductions and it’s perfectly legal to do so. Where things might start to look a little strange to the IRS is if your deductions are out of proportion compared with what they expect. For example, if you earn $50,000 per year and make $49,000 of charitable donations, that might raise some red flags.

Some specific business deductions that you’ll want to watch for are:

High Home Office Deductions

If you work from home and have an area that is regularly and exclusively used for business, you can likely qualify for a home office deduction.

But a high home office deduction could be a flag to the IRS that they want to investigate the deduction a little further. The IRS lays out very specific rules for who can take a home office deduction and how much they are allowed to deduct. So taking a large home office deduction may make the IRS want to check that you’ve gotten the deduction right.

Claiming A Vehicle As 100% Business Use

If you use your car for business use, the IRS has two ways you can take a deduction:

- by using a set mileage rate for every mile you drive for business.

- deducting the expenses related to your car, based on the percentage that you use it in business

Both ways of calculating are legitimate. What might give the IRS a reason to want to look at your records is if, for example, you claim that your personal car is only used for business — that it’s never driven for personal reasons.

Don’t let the fear of an audit stop you from taking deductions you’re legally allowed. Review the rules for the deduction and keep proper documentation to support it.

Rounded Numbers

Another thing that can flag an IRS audit is using round numbers. Your tax return shouldn’t be full of numbers that end neatly in 0 — report the actual amounts. For example, if you have $1,742 in capital gains for the year from selling stocks, you should report $1,742 — don’t round up to $1,750 or down to $1,740 to make your taxes look neater.

Multiple Years Of Business Losses

If you run a business, it is understandable that there will be years you experience a loss. But if you have too many years in a row of business losses, the IRS may want to take another look at your business.

Too many years of losses could signal to the IRS that you’re taking too many business expense deductions or that your business is actually a hobby, rather than a business.

The IRS Audit Process

If you are one of the unlucky people who get audited, you’ll want to know what to expect.

Correspondence Audit

This type of audit takes place entirely through the mail. If you have too many books and records to send via mail, you can request an in-person meeting.

Field Audit

During a field audit, the auditor will meet you at a place of your choice:

- your home

- office

- accountant’s office

Office Audit

With an office audit, your audit will take place at an IRS office.

IRS Audit Records Request

The initial letter notifying you that you’ve been selected for an audit will also tell you what records the IRS is interested in seeing. You should have these on hand, because you are required to keep all supporting records for three years after filing your taxes. That’s right: even if you aren’t being audited, you need to keep all tax information for at least three years after filing.

Some records that the IRS might request include receipts for business deductions and mileage logs for vehicle expense deductions. You can find a more comprehensive list of things the IRS might ask you to provide on their website.

Don’t worry, you don’t have to keep paper copies of your files. You can submit electronic records of anything they’re requesting.

How An Audit Ends

Once you’ve submitted all of the documents the IRS asked to see, the audit will be ended in one of three ways:

- No change: you’ve provided all of the documentation they asked for and they determined that your original tax return was correct. No changes are needed.

- Agreed: The IRS decided that there are necessary changes and you agree to their changes.

- Disagree: The IRS decided that changes need to be made and you disagree with them. If you disagree with the IRS audit findings you can speak with the manager, attend mediation, or file an appeal. If you haven’t already, this is the time to get a professional involved to help you make your case.

Can You Go To Jail For An IRS Audit?

If you run into a situation where you owe money to the government but you can’t pay, will they throw you in jail? Probably not.

Jail time comes when a person tries to evade tax, which is a felony. The penalty for tax evasion is a fine of not more than $100,000 for a person (or $500,000 for a corporation) and imprisonment of no more than five years.

But going to jail because of taxes is rare. In 2020, 324 Americans were arrested and accused of tax fraud.

How To Avoid An IRS Audit: 7 Ways

While there is nothing you can do to guarantee that you will avoid an IRS audit, there are some things that can help you stay off the radar.

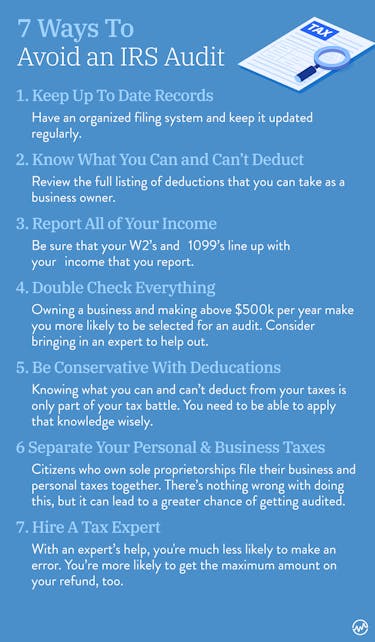

#1: Avoid an IRS Audit by…Keeping Up To Date Records

While we know that taxes are due at the same time each year, yet most of us don’t keep our tax information organized throughout the year.

Have an organized filing system and keep it updated regularly. If you keep receipts electronically, make sure you have a specific folder dedicated to your tax records each year.

With accurate records, not only will you be able to fill out your tax return correctly; if you do get selected for an audit, you won’t have any trouble providing the IRS with exactly what they want to see.

#2: Avoid an IRS Audit by…Knowing What You Can and Can’t Deduct

One of the things listed earlier that will trigger an audit is out-of-proportion deductions. That’s why it’s important to know the rules when it comes to both business and personal deductions (and keep a backup of cash for any deductions that you take).

If you own a business, review the full listing of deductions that you can take. Remember, a person who files Schedule C is more likely to get flagged for an audit. You’ll want to double-check all of the rules before filing your taxes to make sure that you aren’t taking deductions now that will land you in the IRS hot seat later.

#3: Avoid an IRS Audit by…Reporting All of Your Income

You know those forms that you get every year before filing taxes — W2’s and 1099’s? The IRS also gets a copy and uses those forms to double-check against the income that you report. Any discrepancies between what you report and what they receive on those forms is going to jump out as a red flag.

Even if you’re tempted to omit a few small pieces of income from your tax return, reconsider. It’s not worth the hassle (and potential penalties) that come with an audit.

#4: Avoid an IRS Audit by…Double Checking Everything

There are some things that make you more likely to be selected for an audit, like owning a business and making above $500,000 per year. Those aren’t things that you want to change; they’re great things. But knowing that you fall into the higher-risk category means taking extra time to file your return as accurately as possible.

This may mean bringing in an expert to help you do things right. Our tax law is anything but simple and even with the best intentions, you might make a mistake.

You may also want to file electronically. The error rate for a paper return is 21 percent while the error rate for an electronically filed return is 0.5%.

#5: Avoid an IRS Audit by…Being Conservative With Deductions

Knowing what you can and can’t deduct from your taxes is only part of your tax battle. You need to be able to apply that knowledge wisely.

Taking out too many deductions is a clear red flag to the IRS, as we explained above.

You’ll want to take out the deductions allowed by law, though.

The best advice to avoid an audit is to be conservative with any deductions that you do make. Also, be sure to keep paper records or another type of proof regarding your deductions on file in case an audit does occur.

#6: Avoid an IRS Audit by…Separating Your Personal and Business Taxes

Another great way to avoid an audit is to separate your business and personal taxes.

Often, citizens who own sole proprietorships file their business and personal taxes together.

There’s nothing wrong with doing this, but it can lead to a greater chance of getting audited.

#7: Avoid an IRS Audit by…Hiring a Tax Expert

One of the best ways to avoid an IRS audit is to hire a tax expert to help you file your taxes.

With an expert’s help, you're much less likely to make an error. You’re more likely to get the maximum amount on your refund, too.

Even better, if you do end up getting audited, it’s likely that your tax expert will be the one who deals with the IRS rather than yourself.

At the end of the day, your tax return is your responsibility but hiring a tax expert reduces your chances of getting in trouble with the IRS.

The Bottom Line: Avoid an IRS Audit

Being selected for an IRS audit is frustrating and time-consuming. While there’s nothing that can guarantee the IRS will never come knocking, utilize this information to steer clear of potential red flags for the best peace of mind.