Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

- What Is A Reverse Annuity Mortgage?

- How Does A Reverse Annuity Mortgage Work?

- Reverse Annuity Mortgage Advantages

- Reverse Annuity Mortgage Disadvantages

- Reverse Annuity Mortgage Examples

- Who Is the Best Candidate For a Reverse Annuity Mortgage?

- When a Reverse Mortgage is NOT Right For you

- Reverse Annuity Mortgage Frequently Asked Questions

- The Bottom Line: Is a Reverse Annuity Mortgage Right For You?

- Continued Learning: Reverse Annuity Mortgage

What’s more, you don’t have to pay back the loan.

But the process is filled with myths, advantages, disadvantages, and eligibility requirements, making it complex.

So what is a reverse annuity mortgage?

More importantly, is a reverse annuity mortgage right for your financial needs?

In this article, we will explore:

- What a reverse annuity mortgage is

- The advantages and disadvantages associated with a reverse annuity mortgage

- Frequently asked questions

- How to decide if it's right for you

- Additional (and free) retirement and money-saving resources

Let’s get started!

What Is A Reverse Annuity Mortgage?

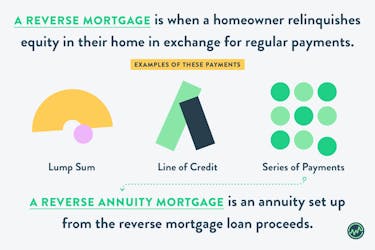

A reverse mortgage is when a homeowner relinquishes equity in their home in exchange for regular payments. This can be in the form of:

- a lump sum

- a line of credit that can be drawn on at the borrower's option

- or in a series of regular payments, called a reverse annuity mortgage

Thus, a reverse annuity mortgage is an annuity set up from the reverse mortgage loan proceeds.

How Does A Reverse Annuity Mortgage Work?

Many people retire with only one asset: the house they live in. Combine this with their only source of income — social security payments — and they might be in need of cash.

By utilizing a reverse annuity mortgage, they would receive monthly payments for the property (based on the equity) that can then be used to their discretion.

Thus, a reverse annuity mortgage is designed for those who are “asset rich and cash poor”.

The house remains in the homeowner's name, and he or she receives this consistent income until:

- death

- sale of the property

- inability to live in the house for a period exceeding 12 consecutive months

Next, let’s look at the advantages and disadvantages of a reverse annuity mortgage.

Reverse Annuity Mortgage Advantages

No Monthly Payment

The primary advantage of a reverse annuity mortgage is that you are not required to make monthly payments on the reverse mortgage loan for as long as you live in the home.

Prevents Downsizing

For many retirees in need of additional income, downsizing to a smaller house or apartment is an option.

However, many don’t prefer this because their home may hold so many memories. A reverse annuity mortgage will keep you from moving out and downsizing.

You Won’t Outlive The Loan

Since insurance companies price the annuity based on your age and create a payout that will continue until your death, you will not outlive the income.

Joint-and-last-survivor annuities can also provide a guaranteed income until both you and your spouse pass away.

You Don’t Repay The Loan

Since the loan is repaid by selling the home after you pass away or when you move elsewhere, such as a retirement facility, you don’t have to repay the loan.

Keep in mind that if you do not pay your property taxes or take care of the property, this can be voided and the loan can be called due. We will discuss this in-depth later on in the article.

Funds Can Be Used for Anything

There is no stipulation on what the funds provided in the reverse annuity mortgage can be used for.

They can be used for:

- health care

- pay taxes

- boost your savings account

- house repairs, such as making it handicapped-accessible

- or other needs you have

Not Liable For More Than The Value Of Your Home

Because a reverse mortgage is a non-recourse loan, you and your children will not be personally liable for any amount of the mortgage that exceeds the value of your home when the loan is repaid.

Refinancing Is Available

In the event that the home’s value increases, the reverse mortgage can be refinanced to increase the payments.

Reverse Annuity Mortgage Disadvantages

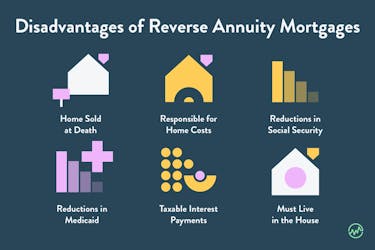

Home Sold At Death

A reverse annuity mortgage uses a home's equity loan to generate additional income and uses the value of the home to repay the loan when you no longer live in the home.

This means the home will be sold at the homeowner’s death unless children have the available funds to purchase it back.

Responsible for Home Costs

Since the title remains in your name with a reverse annuity mortgage, you are responsible for:

- property taxes

- insurance

- utilities

- fuel

- maintenance

- other home expenses

If you don’t pay your property taxes, keep homeowner’s insurance, or maintain your home, the lender might require you to repay your loan.

Possible Reductions in Social Security and Medicaid Reductions

Annuity payouts are considered income by Supplemental Security Income and Medicaid. Because of this, your SSI benefit payments may be reduced.

Also, the annuity income might make you ineligible for Medicaid.

Taxable Interest Payments

While regular loan advances from a home equity line of credit are not taxable, the interest portion of your payout annuity will be treated as taxable income.

As interest accrues, you'll essentially accumulate interest upon interest.

The loan can outgrow the equity left in your home so you (and your heirs) will be left with no assets in the property.

Must Live in the House

Homeowners who obtain reverse mortgages must also live in the house, or else the loan can be nullified and lenders can foreclose on the property.

Next, we’ll look at who is the best candidate for a reverse annuity mortgage.

Reverse Annuity Mortgage Examples

So how does a reverse annuity mortgage look in real-life examples? Let’s take a look at John in a few scenarios.

Scenario #1: Taking out Reverse Annuity Mortgage to Invest Elsewhere

John is 62 years old and owns a home worth $300,000, which doesn’t have a mortgage. John’s not happy with the performance of his retirement savings, so he takes a reverse annuity mortgage for $250,000 and uses the cash to buy other investments.

Let’s assume John’s house is located in the best neighborhood in his county.

As a result, the property’s value increases to $350,000. John dies and leaves the house to his son.

The reverse annuity mortgage lender has a claim worth $250,000 since John died.

For John’s son to claim the house, he must repay the $250,000 loan his dad made.

If he doesn’t, the lender will sell the property at auction to recoup the amount owed on the loan, and then give the remaining $50,000 to John’s son.

Scenario #2: Depreciation with a Reverse Annuity Mortgage

Now, let’s assume John’s neighborhood declined, and his property’s value depreciated years after he received the reverse annuity mortgage.

After years of accruing interest, the loan is now worth $300,000.

However, the house has depreciated and is now only valued at $250,000 as of John’s death.

Although the reverse annuity mortgage balance has increased to $300,000 due to interest and time, the lender can only recoup the house’s value: $250,000.

John’s son can pay this if the property means this much to him, or the bank can sell the property at auction. Regardless, John’s son isn’t required to pay more than the house is worth.

The examples above are not only applicable to the death of the homeowner but are also true if the owner wants to sell in the case of a reverse annuity mortgage.

Remember, the lender can only collect the lesser of the balance of the remaining loan or the house’s value.

So, in our first scenario, if John sells his house for $350,000, he must pay the lender $250,000.

This leaves John with $100,000 to use in his next purchase.

Using our second scenario above, let’s say John sells his house while the value is down at $250,000 and the mortgage balance is at $300,000. John must pay the lender the $250,000.

While he won’t be responsible for the remaining $50,000 balance on the loan, he also doesn’t have any cash from the sale to apply to his next purchase.

Who Is the Best Candidate For a Reverse Annuity Mortgage?

The best candidates for a reverse annuity mortgage are those who:

- have paid off their house

- aren’t looking to sell or move

- are looking for additional income

- do not plan on leaving the house to children

Here are some examples of eligibility requirements for a reverse annuity mortgage (RAM).

Examples of Eligibility Requirements

While federal laws govern reverse annuity mortgages, some states have their own regulations that manage how these loans are handled.

Most laws are associated with:

- the homeowner’s age

- the dwelling

- repayment stipulations

The laws also manage interest rates and the rights of you and your lender in the event of a default.

If you are considering a reverse mortgage, you must understand the laws in the state where you reside, as they vary significantly per state.

Federal Reverse Annuity Mortgage (RAM)

HUD's Federal Housing Administration (FHA) offers federally insured RAMs to homeowners who

- are at least 62 years old

- own their homes outright or have a low mortgage balance that can be paid off at closing with the loan proceeds

- live in the home for which they seek the RAM.

To be eligible, qualified homeowners also must receive consumer information from HUD-approved counseling sources before receiving the loan.

Connecticut Housing Finance Authority RAM

Eligibility requirements for the Connecticut Housing Finance Authority's RAM includes:

- You must be at least 70 years old and own a single-family home or condo.

- Your spouse must be at least 70 years old and have a joint ownership interest in the property with rights of survivorship, unless he or she is institutionalized.

- You or your spouse must have long-term care needs.

- Your household income must fall within the CHFA Statewide Income Limits. The CHFA Resource Map can tell you if you are within program eligibility limits.

- Your home must be free of any mortgage or lien at the time of closing.

- You or your authorized representative must complete Reverse Mortgage counseling in person or by telephone, from a HUD-Approved Housing Counseling Agency and submit your certificate.

New York

To be eligible for a reverse annuity mortgage in New York, you must:

- Own your home

- Be at least 60 years of age (NY offers two RAMs depending on the borrower’s age)

- Live in your home for over half of the year

- Have a single-family home, a 1- to 4-unit building or federally-approved condominium or planned unit development

- Have no liens on your home, or qualify for a large enough cash advance from the RAM to pay off existing liens

- Qualify for a large enough cash advance from the RAM to pay for the cost of any necessary repairs

Georgia

In the state of Georgia, eligibility requirements for a reverse annuity mortgage are:

- Borrowers must be at least 62 years of age

- The borrower’s home must be the primary residence, and they live there the majority of the year

- Borrowers must own their home outright or have a low mortgage balance that can be paid when you close on the reverse mortgage

- Borrowers cannot owe any federal debt and can use money from the RAM to pay any that exists

- They must continue paying taxes, insurance, and maintenance costs

- The home must meet the required standards

- Borrowers must receive counseling from a HUD-approved reverse mortgage counseling agency

Montana Housing RAM

Eligibility requirements for the Montana Housing RAM include:

Age Requirements

All borrowers must be 68 years of age or older

Income Limits

The borrower’s annual family income must not exceed the following:

- 1 Person Household $25,520

- 2 Person Household $34,480

- 3+ Person Household $43,440

Property Eligibility

The home must be located in Montana. The borrower(s) must be the owner and occupant of a single-family dwelling that is unencumbered by any prior mortgage, lien or pledge.

A single-family dwelling must meet minimum appraisal standards.

Mobile and manufactured homes are excluded from eligibility.

When a Reverse Mortgage is NOT Right For you

While the lack of a required monthly payment may make reverse mortgages appealing, remember that repayment is due in full when you move from the house.

Keeping this in mind, let’s discuss a few situations in which a reverse annuity mortgage may not be right for you:

Moving

It doesn’t matter if you are moving due to a job change, a desire for a warmer climate, or because of health reasons, a reverse mortgage is not right for you.

You will likely owe all of the equity you make from a sale to the lender, leaving nothing to help with the expenses of your next home.

If you’re thinking of moving, we don’t recommend a reverse annuity mortgage.

Estate

Another reason a reverse annuity mortgage might not be suitable is if you want to assign your home to another party upon your death.

Perhaps your home has been in the family for a long time, and you’d like to leave it with your children.

As we’ve discussed, the loan is due in full upon your death, so your kids will be forced to pay the loan if they want to keep the property.

Otherwise, the lender will sell it at auction.

Little Equity

Equity in your home is the basis of a reverse mortgage.

The home must be mortgage-free or has such a small balance that it can be paid at closing.

Reverse Annuity Mortgage Frequently Asked Questions

Next, we’ll explore some of the most frequently asked questions about a reverse annuity mortgage.

Q. What Happens If You Die Soon After Signing A Reverse Annuity Mortgage?

Using a Home Equity Conversion Mortgage (HECM) as an example, if you pass away shortly after the HECM loan originated, your estate will pay back only the loan balance. In this case, because of the short amount of time, this amount would be small.

Q. Can You Pay Back A Reverse Annuity Mortgage?

These loans are repaid when you move out of the home or when you pass away.

Keep in mind that the loan may need to be paid back sooner if you don’t keep up with the property or your property taxes.

Q. What Happens If You Outlive Your Reverse Annuity Mortgage?

Because insurance companies specifically price the annuity based on your personal factors, such as your age and health, that payout will continue until your death.

No, you won’t outlive the income.

Q. What happens to a spouse in the event of Death?

Using the Home Equity Conversion Mortgage (HECM) as an example, if you signed the loan paperwork and your spouse didn’t, your spouse can continue to live in the home even after you die if he or she pays taxes and insurance, and continues to maintain the property.

But your spouse will stop getting money from the HECM, since he or she wasn’t part of the loan agreement.

Q. Can You Cancel A Reverse Annuity Mortgage?

Once a reverse annuity mortgage is put into place, you won’t be able to cancel or adjust it in any way. That’s why it’s so important to make sure that it’s best for you before signing.

Q. What is the best age to take a reverse mortgage?

Most lenders require reverse mortgage borrowers to be a minimum of 62 years old, while some states require older borrowers.

Q. What's the interest rate on a reverse mortgage?

Interest rates for reverse annuity mortgages are typically higher than standard mortgages.

They can be fixed or variable and range from 5.8% to 8.9%, depending on the type of reverse mortgage.

You are paying compound interest and are not making monthly payments, so the loan balance can grow over time.

Q. What are the three types of reverse mortgages?

The three types of reverse annuity mortgages are The Home Equity Conversion Mortgage (HECM), Single-Purpose Reverse Mortgage, and Proprietary or “Jumbo” Mortgage.

The HECM is a standard reverse mortgage that is overseen by the Federal Housing Association (FHA). The FHA insures the mortgage, allowing lenders to offer better terms while protecting borrowers.

Single-Purpose Reverse Mortgages were created to pay for specific, lender-approved expenses homeowners may have. These expenses are usually related to homeownership, such as paying property taxes or making repairs.

Proprietary or Jumbo Mortgages are designed for larger reverse mortgages. Due to FHA rules, lenders cannot issue HECMs worth more than $726,525, so high-value homeowners utilize these Jumbo mortgages to access more capital.

The Bottom Line: Is a Reverse Annuity Mortgage Right For You?

Whether or not a reverse annuity mortgage is right for you and your financial goals is entirely your decision.

If you do not plan to leave your house to your children, it’s already paid off, and you want to boost your income, it could be a viable option.

But if you’re looking to leave something behind or your house is not paid off, it might not be the best route for you.

Either way, the important thing is to not feel pressured and take time to think it over. If a salesperson is pressuring you to make a decision, that’s a red flag. On the topic of feeling pressured, the Federal Trade Commission says:

“Some reverse mortgage sales people might suggest ways to invest the money from your reverse mortgage – even pressuring you to buy other financial products, like an annuity or long-term care insurance. Resist that pressure. If you buy those kinds of financial products, you could lose the money you get from your reverse mortgage. You don’t have to buy any financial products, services or investment to get a reverse mortgage. In fact, in some situations, it’s illegal to require you to buy other products to get a reverse mortgage.”

Just to reiterate the critical point: if you are told that you have to buy an annuity for a reverse mortgage, remember that federal law prohibits anyone from requiring you to buy a financial product (such as an annuity) in order to obtain a reverse mortgage.

At the end of the day, you know your financial needs more than anyone, so the decision lies with you.

Continued Learning: Reverse Annuity Mortgage

Now that you know the intricacies of a reverse annuity mortgage, here are more resources to enhance your retirement and boost your savings:

- Here is a guide that explains how annuities work

- Try one of these 10 low-cost alternatives to cable TV

- Use this strategy to immediately lower your cell phone bill

- Discover how to rescue your retirement from inflation

- Here are 7 bills that you can actually negotiate and save money

- Use this 4-step blueprint to retire early