Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

In the course Paying for College, Ellen Long takes a completely counter-intuitive approach to teach you how to avoid student loans.

The College Debt Crisis

With skyrocketing college costs and so many college graduates struggling with student debt, getting a college education without debt may seem like a fantasy. But, if you reverse-engineer your approach to college, getting a degree without the shackles of debt IS within reach.

The reality is that the cost of college is expensive — and ever-increasing. The cost of getting a degree is now increasing over 8 times faster than wage growth.

What’s more, over 44 million Americans have outstanding student loan debt. The same study found that student debt in the U.S. now totals more than $1.5 trillion.

The average graduate from the class of 2018 graduated with an average of $29,200 in student debt.

While college is costly, it’s still one of the best ways for people to get ahead financially.

College graduates earn on average $1 million more over their lifetime than people who don’t attend college.

Plus, many companies require an undergraduate degree to simply apply for a job.

But if you don’t learn how to avoid student loans and you graduate in debt, your career and life choices may feel limited. The life you wanted to live may feel like it’s out of reach.

Paying off debt can take years, and limit your career choices.

Given that college is expensive, we’re taking on more debt than ever, and that debt is impacting our choices, why don’t more people teach you how to avoid student loans? It’s a problem that Paying for College aims to alleviate.

How To Avoid Student Loans: The Premise

Most of us decide on our college and career in this order:

- first, choose your college

- then choose your major

- finally, choose your career

According to Long, that approach doesn’t help you figure out how to avoid student loans.

To do college better, cheaper, and faster, you should work to have a clear end goal.

That boils down to one question: what career do you want to have?

Once you know the career you’re working towards, you can easily choose a major (that you don’t change multiple times, thus lengthening your college stay).

And once you know what you want to major in, it’ll make picking a college easier.

If you decide that you want to be, for example, a doctor, there are majors that will help set you up for that career, such as, biology or another science.

Once you know you want to major in biology, selecting a college with a good biology department will be at the top of your list of criteria for schools.

When figuring out how to avoid student loans, knowing your end goal and reverse-engineering the best way to get there can make a huge difference in the final cost of college.

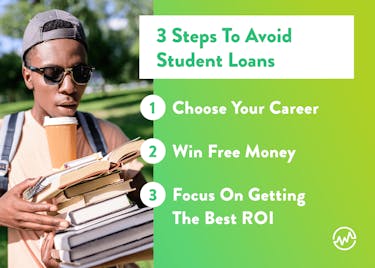

How To Avoid Student Loans: The 3 Step Process

Reverse engineering your success to a debt-free college degree isn’t easy. If it was, everyone would be doing it. The truth is that the process takes time, motivation and self-reflection.

Long breaks this down into a few steps to help you navigate the process.

Step 1: Choose your career

As mentioned above, choosing your career will help you decide what you’ll major in and even what college you’ll want to attend.

But how do you figure out what you want to do while you’re still in high school?

It seems impossible — when you’re 17 or 18, you don’t know enough about career options to make a decision.

Long suggests you spend your time doing in-depth research on a number of different ways.

One of the first things she suggests you do is understand

- who you are

- what you enjoy doing

- what your strengths and weaknesses are

You may find personality tests or career tests helpful here. And Long also recommends that you ask friends and family what you’re good at, because they may be able to give you objective advice.

Once you know what you’re good at and you have a list of careers that might interest you, it’s time to dig deeper. Long suggests a three-pronged approach:

Researching Careers In-Depth

Begin by creating a list of each of these careers, and find information on the following:

- day to day activities of the job

- skills/education required for the job

- how much entry-level pay is, and how it increases as you gain more experience

- changes that industry has seen recently

- the best companies or locations for this particular job/industry

Interview Workers In The Industry

Next, interview employees or employers in those current careers. How can you do this? You can try an email correspondence, or offer to buy them coffee or lunch.

Here are a few interview questions:

- What skills are required in your position on a day-to-day basis?

- What parts of your job do you find most challenging?

- Are there any negatives to your job?

- Is this field growing or dying?

- Where do you think the changes will happen in the next five years?

- What is the advancement potential in the field?

- What educational preparation would you recommend for someone who wants to advance in this field?

- What qualifications do you seek in a new hire?

Job Shadowing

The goal of job shadowing is to spend a day with a worker or a company to experience a true day in the life of that job role.

It’s an exercise that can have reverberating effects. For example, let’s say that you want to work as a reporter at a news station. You shadow a reporter for a day and realize that it’s actually not something you’d like to make a career out of. You can then easily pivot and begin thinking of other careers. Many people wait until their first day on the job to experience what it’s truly like, and making a pivot then can be costly — after all, they already have a degree catered towards that job, and they need income. That’s a recipe to end up in a job and career that you are truly unhappy with.

Researching and determining the career you want before college will help you save time and money.

While other students will be mulling over classes to take and changing their majors, you will be fast-tracking your way through college and towards your dream career.

Step 2: Win Free Money

Once you know what you want to do, it’s time to start thinking about how you’ll pay for the education that will get you into that career.

What better way to pay for college than with free money?

One of the crucial pieces of advice on how to avoid student loans is to apply for scholarships.

You may worry that scholarships are just for a certain type of student — the straight-A student that wins every award. Not so, says Long.

Once you know what scholarship committees care about, you can successfully earn scholarships. So what do scholarship committees care about? Long says that most look for:

- A minimum GPA of 2.75

- Commitment to a cause

- Extracurricular activities

- Personal letters of recommendation

Improving in those four areas will help you increase your odds of earning scholarships and graduating debt-free.

If you are still looking for ways to pay for college after scholarships, remember that there isn’t a limit to how much you can make — in your free time, explore ways to generate extra income with a side hustle or create a microbusiness.

Step 3: Focus On Getting The Best ROI

College is expensive. But costs can vary widely depending on where you decide to go to school.

The average cost per year (tuition, fees, room, and board) was $17,237 for a public university and $44,551 for a private university in the 2016-17 academic year.

When you’re trying to figure out how to avoid student loans, should you always opt for the cheapest tuition?

Long says rather than focusing on the cost, start thinking about the return on investment (ROI).

That means looking at how much your college will cost compared to the average salary for that occupation.

Here’s a quick exercise: if you already know what your career path, find the average salary for that position, and compare it to the cost of a degree from a few universities you are interested in.

For example, if you want to want to be a teacher, and the average starting salary for a teacher in your area is $37,000, does it make sense attending a private university that is $40,000 per year, which equates to $160,000 for a 4-year degree? Absolutely not.

Seeing the actual cost and the ROI makes picking a college and a career that much easier.

Also, consider if you will need additional education after obtaining your undergraduate degree. If you want to become a lawyer, you’ll have to attend law school. Knowing this ahead of time will help you realize the full cost of your education.

How To Avoid Student Loans

Remember: college isn’t something you should do because just because everyone else is doing it. It’s an investment in yourself and your future.

If you want to learn how to avoid student loans, Long’s course Paying for College lays out an excellent approach that will get you thinking differently about the cost of college.

It’s this strategic and goal-oriented thinking that will separate you from everyone else in the classroom and can potentially keep you from taking on significant debt before you even begin your career.