Are you looking for a way to pay less interest on the credit card debt you owe?

If you’ve finally figured out how to stop increasing your credit card balances and start paying off the debt, a balance transfer is one option that can help.

In many cases, balance transfers can help you pay off your debt faster and save you some serious cash at the same time. Balance transfers don’t come without risks, though.

If you’re not careful, you could end up paying more interest over the long run. Even worse, you could end up in even more debt.

Here’s what you need to know about how to do a balance transfer and what to watch out for.

What Exactly Is a Balance Transfer?

A balance transfer is a simple transaction that occurs between two credit card accounts.

During this transaction, you use your available credit on a new or existing credit card to pay off another credit card balance.

The credit card companies take care of all of the work behind the scenes. Then, the balance moves from one card to the other.

While moving debt around may not seem like it accomplishes much, balance transfers can greatly benefit you if used correctly.

That’s why it’s important to understand how to do a balance transfer and what to consider before you do.

How To Do a Balance Transfer

Learning how to do a balance transfer isn’t hard. Here’s what you need to know.

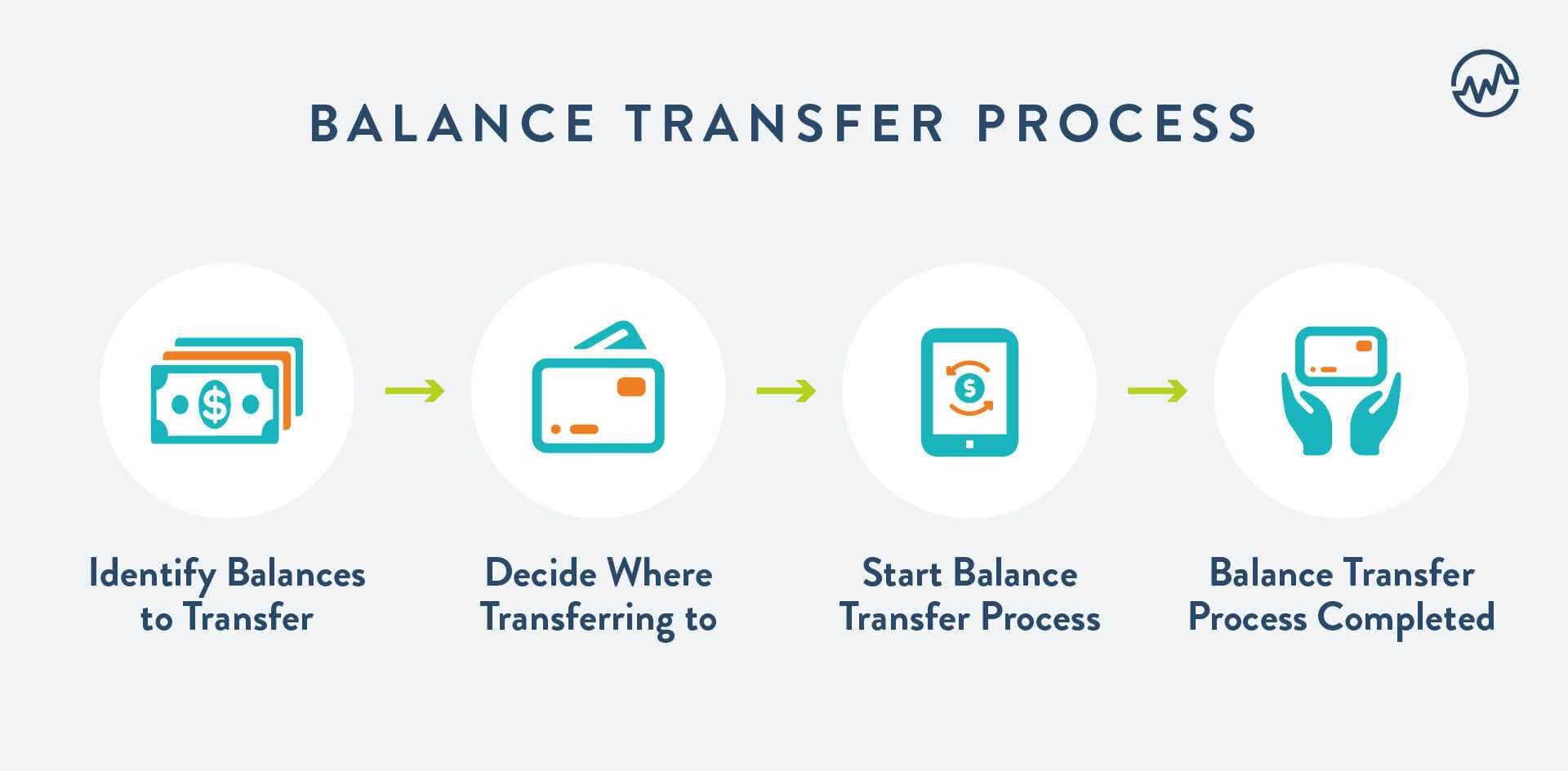

1) Identify the balances you want to transfer.

2) Next, you’ll need to figure out where you’re transferring the balances to. You’ll be transferring the balance to either an existing credit card or a new credit card account.

You should research the card you’re transferring the balance to before you start to verify you can proceed as planned. Make sure you have enough available credit to transfer the balance and the transfer won’t exceed any balance transfer limits or violate other rules the card imposes.

3) After you’ve verified you can make the transfer, it’s time to start the balance transfer process. You can do this in one of many ways, but all methods require using the credit card you’re transferring the balance to, not the credit card you’re transferring the balance from.

The easiest way to start this process is by using your credit card’s website or calling their customer service number. You’ll need to enter the account information, which may include:

- The name of the bank

- The address you send payments to

- The amount you’re transferring

- The credit card number of the account you want to pay off

4) After you give the necessary information to start the balance transfer, the transfer will begin processing.

Depending on the credit cards involved, the balance transfer typically takes a few days to go through but may take as long as a few weeks in some circumstances.

Eventually, the original balance will be paid off. The balance on your other account will increase, completing the balance transfer process.

Good Reasons You May Want to Transfer a Balance

There are many reasons you may want to learn how to do a balance transfer.

For instance, balance transfers could save you a ton of money if you’re paying off debt and want to pay less interest.

By transferring the remaining balance you owe to a credit card with an introductory 0% APR period on balance transfers, you immediately stop interest from accruing after the balance transfer takes place.

As long as you pay the balance transferred off before the introductory period ends, you could pay no interest at all.

Unfortunately, sometimes you aren’t able to pay the balance transferred before the introductory period expires.

If the balance transfer offer period is about to expire on your current card, you can transfer the remaining balance to another credit card with an introductory 0% APR period on balance transfers offer.

This allows you to continue paying off the debt while still avoiding interest payments.

Alternatively, you could transfer the balance to a card with a low but permanent APR on balance transfers.

This may work better if you don’t like dealing with the hassle of multiple balance transfers and know it will take an extended period to repay the balance you owe.

Transferring a balance from a maxed-out credit card to a credit card with a high credit limit could even help improve your credit score.

Of course, each person’s credit situation is unique. Read further to learn more about how balance transfers can impact your credit.

How Long Does a Balance Transfer Take?

Typically, a balance transfer takes five to seven days to move a balance from one credit card to another. credit card to another.

But the worst-case scenario is 14-21 days, depending on the credit card company.

Keep in mind that if the balance transfer happens after interest is charged for the month, you are still responsible for that extra interest — not the new credit issuer.

Be sure to ask the credit card issuer before relying on them for a balance transfer.

How To Do A Balance Transfer: Advantages

There are many reasons you may want to learn how to do a balance transfer.

For instance, balance transfers could save you a ton of money if you’re paying off debt and want to pay less interest.

By transferring the remaining balance you owe to a credit card with an introductory 0% APR period on balance transfers, you immediately stop interest from accruing after the balance transfer takes place.

As long as you pay the balance transferred off before the introductory period ends, you could pay no interest at all.

Unfortunately, sometimes you aren’t able to pay the balance transfer before the introductory period expires.

If the balance transfer offer period is about to expire on your current card, you can transfer the remaining balance to another credit card with an introductory 0% APR period on the balance transfer offer.

This allows you to continue paying off the debt while still avoiding interest payments.

Alternatively, you could transfer the balance to a card with a low but permanent APR on balance transfers.

This may work better if you don’t like dealing with the hassle of multiple balance transfers and know it will take an extended period to repay the balance you owe.

Transferring a balance from a maxed-out credit card to a credit card with a high credit limit could even help improve your credit score.

Of course, each person’s credit situation is unique. Read further to learn more about how balance transfers can impact your credit.

How To Do A Balance Transfer: Disadvantages

Despite the allure of paying no interest on your balance transfer during an introductory period, balance transfers aren’t always smart money moves. Even if you have the best intentions, life doesn’t always work out as you hope it would.

Having a balance transfer not work out as you thought it would result in serious negative consequences.

If you’re just getting started on your financial awakening, a balance transfer could even have devastating results. devastating results.

Here’s how: you generally transfer balances with the best intentions of paying off the balance before the introductory period expires. Then, reality hits.

You may lose motivation or have unexpected expenses pop up—these things can derail your financial plan quickly.

In these cases, you may fail to pay off the balance transferred and run up a balance on the old credit card again to cover these unexpected expenses.

Once the introductory period expires, you’re stuck paying interest on both balances.

This worst-case scenario ends up with you owing even more debt than when you started. Sadly, this happens more often than you’d think.

How To Do a Balance Transfer: What To Look For

Once you know how to do a balance transfer and decide it’s a smart move for you, you’ll want to find the best balance transfer offers you can qualify for.

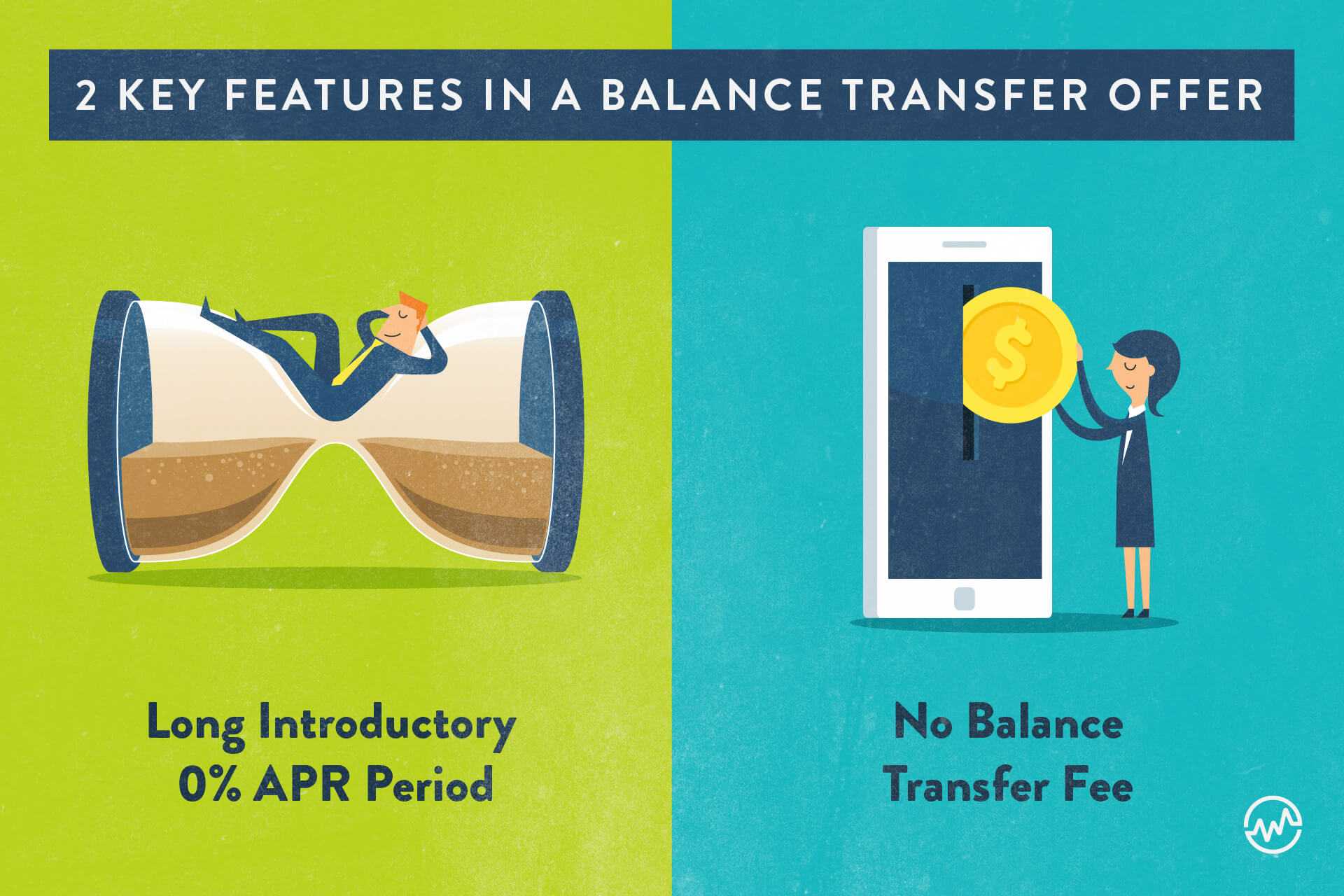

In particular, there are two features you should focus on.

First, a long introductory 0% APR period on balance transfers. Currently, the longest introductory period lasts 21 months.

Even so, many top cards only have 15 and 18 month introductory periods.

Second, a no balance transfer fee.

The absolute best balance transfer fee available is a no fee balance transfer.

No fee balance transfers typically require you to transfer the balance within the first couple of months after opening a new credit card.

When you pay a balance transfer fee, you are paying to have your credit card balance transferred from one card to another.

Paying between 3% and 5% of your balance is typical.

On top of that card, issuers can also charge a $5 to $10 fee.

To put that into perspective, let’s look at an example. Say you’re doing a balance transfer on your $5,000 credit card balance. The card company has a 3% fee with a nominal $5 fee.

You must pay $155 to transfer this balance to a new card.

You can shop around and find a card that offers a low or no-cost balance transfer solution. Here’s what to look for:

- 0% intro APR for a balance transfer

- No balance transfer fee

- No annual fees because you will have to pay this upfront

No card will be perfect, and it will be hard to find all of the above.

But you can weigh the pros and cons of your unique situation.

Besides looking at your pile of credit card mailers in your junk mail, you can shop around for the card for your balance transfer online.

Compare several cards before making the plunge.

Other Things to Consider Before Transferring a Balance

Before you transfer a balance, make sure you understand all the details about how they work and the particular offer you’re taking advantage of.

There are many intricacies other than balance transfer fees and introductory 0% APR periods that may create issues for your plan.

If you’re applying for a new credit card to begin a balance transfer, you aren’t guaranteed your new credit limit will be sufficient to transfer the balance you plan to transfer. In fact, it’s not uncommon to get approved for a credit limit less than the amount you had planned to transfer.

In this case, you have to decide if doing a partial balance transfer, maxing out your new credit limit, and potentially damaging your credit score is worth saving money on interest payments.

To make matters even more confusing, some credit cards have balance transfer limits set lower than your credit limit.

Even if you get approved for a $15,000 credit limit, the credit card may only allow you to use a certain amount, such as $5,000, toward balance transfers.

This can greatly limit the amount of interest you can save if you planned to transfer large balances.

Most banks won’t allow you to transfer a balance from one of their credit cards to another one of their credit cards or a credit card of their affiliated companies.

For example, Chase won’t allow you to transfer a balance from a Chase Freedom credit card to a Chase Slate credit card.

If you aren’t careful, you can lose your introductory 0% APR on balance transfer before the period expires.

Some credit cards even reserve the right to revoke the introductory 0% APR if you make a late payment or break other rules outlined in your cardmember agreement.

Make sure to read the agreement in full to see how you could lose your promotional 0% APR early so you can avoid these pitfalls.

Finally, don’t quit making payments on your old accounts you’re transferring balances away from until the balance transfer is complete.

Sometimes it takes a few days or even weeks to get approved for a new card and process the balance transfer request.

If you quit making payments on your old account the day you’re approved for a new balance transfer card, you may miss a payment on your old debt before the balance transfers.

This could result in late fees and damage your credit.

Are Balance Transfers Bad for Your Credit?

The actual act of transferring a balance isn’t necessarily bad for your credit.

Yes, it is possible transferring a balance could result in a negative impact on your credit score in certain cases.

At the same time, it could improve your score if you transfer the balances in a smart way.

As with most things credit related, there are many moving parts in a balance transfer.

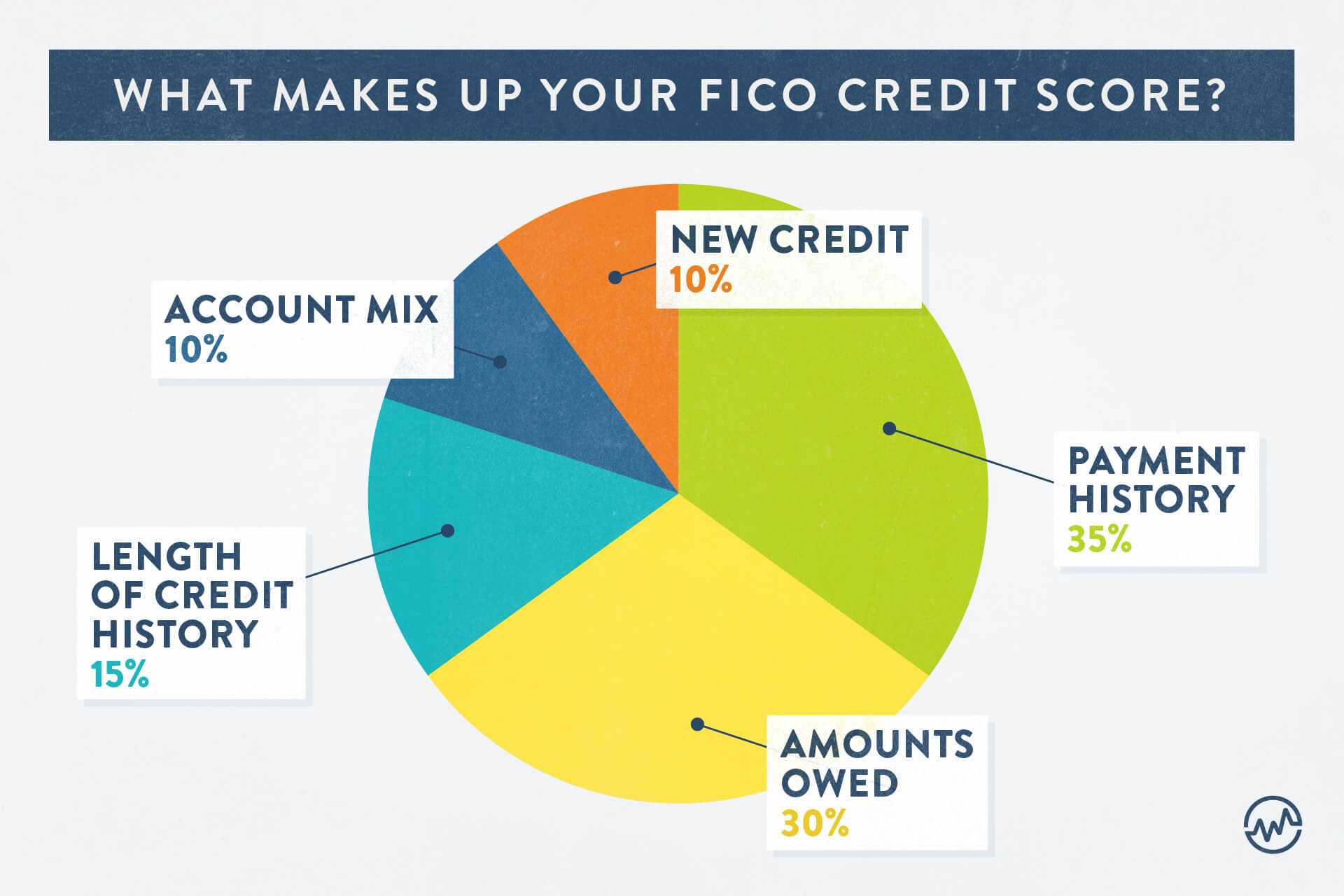

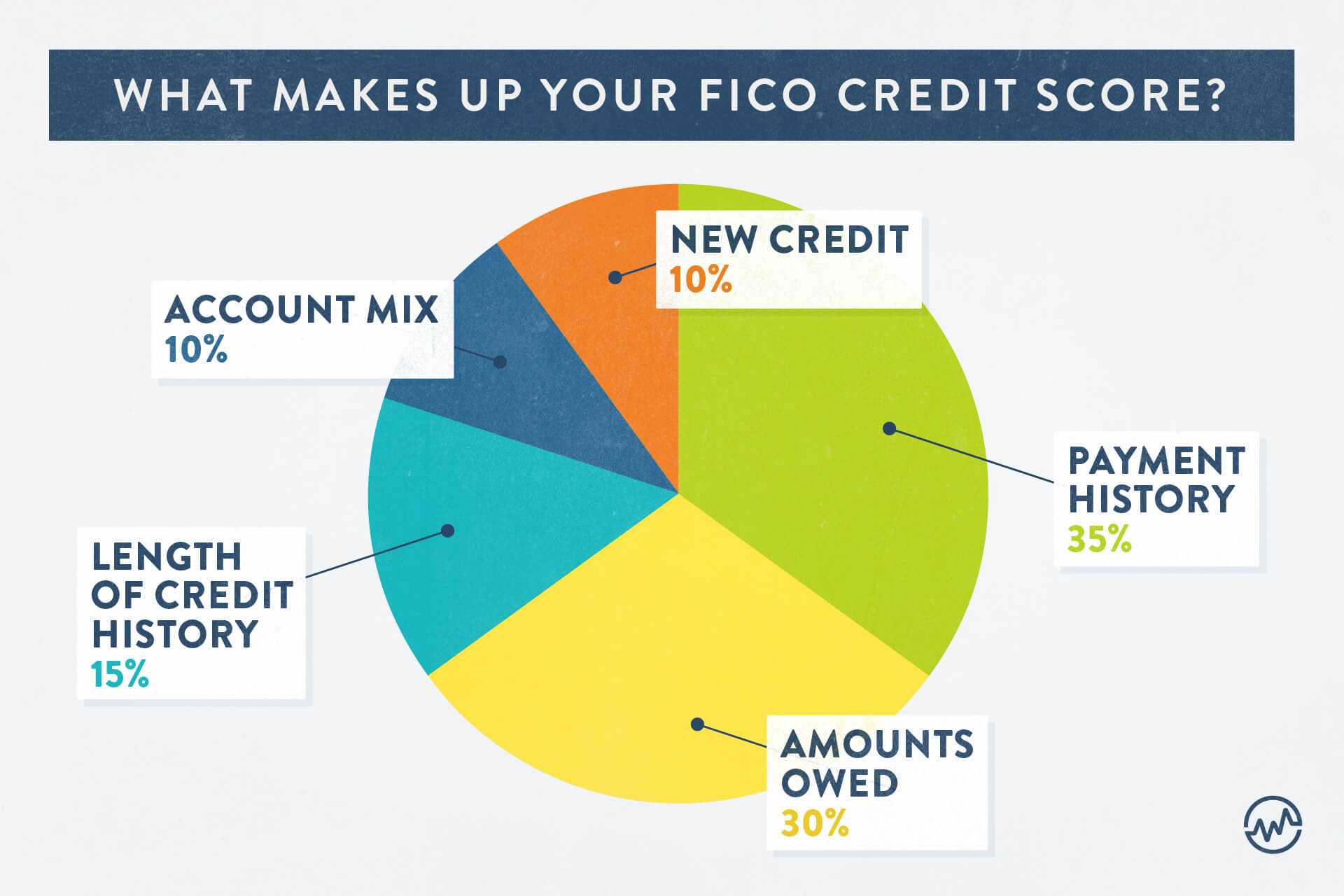

Each one of these moving parts can impact your credit either in a positive or negative way. Your FICO credit score consists of five major factors:

Transferring a balance won’t impact your payment history unless you miss a payment, but depending on how you handle your balance transfer it could impact the other categories.

The biggest impact may fall in the amounts owed portion of your credit score.

While your total debt won’t change drastically other than the potential addition of a balance transfer fee, the ratio of your debt to your credit limit could change on individual cards and overall.

The length of credit history, account mix and new credit parts of your score can all be affected if you open a new card to take advantage of a balance transfer offer.

Opening a new card can also impact the amounts owed category of your score by increasing your total credit available, which could help.

Opening a new credit account would decrease the average age of your credit accounts in the length of credit history part of your score.

This shouldn’t have a huge impact on your score overall, especially if you have a long credit history or many accounts.

Your account mix could be slightly affected depending on the types of credit you hold, but this won’t normally result in a major credit score change either.

The new credit portion of your score usually declines temporarily due to opening a new card. This impact is usually small and quickly disappears over a few months.

Balance Transfer Example: When It’s Good

Ideally, you want to do a balance transfer with the lowest possible rate.

Here’s a scenario where it works:

You have a $3,000 balance on a credit card with an 18% APR.

You make a plan to pay $200 a month to get rid of this bill.

It will take one and half years to pay off, and in this time, you will pay $423.99 in interest.

If you went for a balance transfer with a card that doesn’t start charging interest for an entire year, you would save significantly on interest as you pay down the card.

Balance Transfer Example: When It’s Bad

Balance transfers are not always worth it after you do the math.

Let’s say your $3,000 balance starts on a credit card that has a 30% interest rate. You decide to go for a balance transfer that has a lower interest rate. You reason it is worth the 3% transfer fee because you will pay less in the long run.

But hold on.

With a 3% transfer fee and a 27% APR, you pay $810 a year with a $90 transfer fee. You’re only breaking even.

If you’re trying to pay off your credit card bill fast, then it’s not worth it.

Keep shopping around.

The Bottom Line: How To Do a Balance Transfer

Balance transfers are an amazing tool: they could save you hundreds or even thousands of dollars in interest payments as you pay off your debt.

Plus, they can alleviate financial stress.

On the other end of the spectrum, balance transfers could be a trap that results in racking up even more debt.

Carefully examine your financial situation to see if you can realistically pay off the balance you want to transfer before the introductory period expires.

If you can and you know you’ll stick to the plan, an introductory 0% APR period on balance transfers offer might be right for you.

If you know you can’t commit to making it work, consider transferring the balance to a low APR credit card instead.

By exploring ways to eliminate debt potentially through balance transfer options, not only are you increasing your financial awareness; you’re also taking steps towards financial freedom.