The 609 Credit Repair Letter Template

In This Article

Have you ever applied for a loan, whether it was for housing, a car loan, or other types of financing only to be denied because of poor credit?

If so, there is a powerful credit repair secret that you may not have used or even heard of.

It’s called the 609 Letter.

A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t meet the requirements for.

It’s another effective strategy to add to your overall credit improvement strategy.

In this article, we’ll explain:

- What a 609 letter is — and how to use it

- Three different ways to obtain a 609 letter, including using a 609 dispute letter for free

- Frequently asked questions (and their answers) associated with a 609 letter

If you're ready to learn everything you need to know about a 609 letter, let's begin!

What is a 609 Letter?

A 609 letter requests eliminating inaccurate information from your credit report from the major credit reporting bureaus.

This credit-fixing letter goes by many aliases:

- 609 letter

- 609 credit repair

- 609 dispute letter

- credit repair letter

- section 609 credit repair

Under the Fair Credit Reporting Act, you can dispute any inaccurate information.

So by viewing the details of your credit report, you can more accurately dispute errors through a 609 letter.

Let’s dive into the Fair Credit Reporting Act so you can use it to your advantage to improve your credit.

What is the 609 Letter “Loophole”? (FCRA Explained)

The Fair Credit Reporting Act may not sound that interesting, but it’s important to know what it is and how it affects you if you’re going to utilize the 609 credit repair strategy.

The credit bureaus can do a lot without your permission. They are:

- Equifax

- TransUnion

- Experian

They can collect information about you behind your back, store that information, and then put that information into reports which they sell to others.

Even worse: you don’t get a say in any of this.

However, the credit bureaus have rules to follow too. Namely, they are required to abide by the Fair Credit Reporting Act (FCRA).

The FCRA (pronounced FICK-RAH in the credit world) is the chief federal law that tells the credit bureaus what they can and cannot do when it comes to credit reporting.

What Is Section 609?

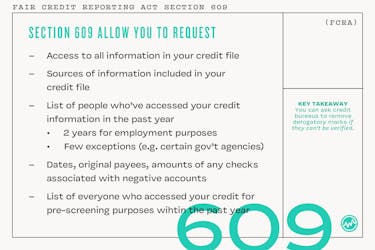

The FCRA is chock-full of rights that you (as a consumer) can exercise when it comes to credit reporting.

FCRA Section 609 deals with a series of those rights.

But there’s a catch.

The rights aren’t given to you automatically.

If you want to take advantage of the protections afforded to you under Section 609 you need to be proactive and put in a request.

The section also addresses a “summary of rights” for consumers which must be included with agency disclosures.

One of those rights essentially states that a credit bureau doesn’t have to remove derogatory information from your file unless it cannot be verified.

What does that mean?

If an item on your credit report isn’t verifiable, you can ask for it to be removed.

The 609 Letter

In order to take advantage of Section 609 credit repair, you need to write a 609 dispute letter.

A 609 letter is the request you can send to credit bureaus if you wish to exercise any of the rights detailed above.

Although Section 609 of the FCRA doesn’t technically give you the right to dispute information on your credit reports (that’s dealt with in FCRA Sections 611 and 623), many people combine their right to dispute with their Section 609 rights in the same letter.

The result of this combination?

You might see an unverifiable derogatory account deleted from your credit reports, which will then increase your credit score.

Keep in mind that there is something else that can happen.

The other option is that the item could also be verified as accurate, stay put, and actually lower your credit score.

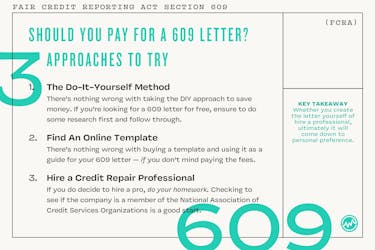

3 Ways To Create A 609 Letter

1. The Do-It-Yourself Method

There’s nothing wrong with taking the DIY approach to save money. If you’re looking for a 609 letter for free, ensure to do some research first and follow through.

After you have written the letter, you should send it to all 3 credit bureaus if the information you are disputing appears on all 3 credit reports.

Certified mail may also be helpful.

2. Purchase A 609 Letter Template Online

On the other hand, there’s nothing wrong with buying a template and using it as a guide for your 609 letter — if you don’t mind paying the fees.

Before you make the transaction, ensure that the template is geared for this type of request.

3. Hire A Credit Repair Professional

If you do decide to hire a pro, do your homework.

Checking to see if the company is a member of the National Association of Credit Services Organizations is a good start. Like any business, some of the companies that offer help with 609 letters may be legitimate with some may not be.

Ultimately, it comes down to personal preference.

609 Letter Template

Here’s a template you can use to send a 609 letter to Experian, TransUnion, or Equifax.

Be sure to fill in the blanks with your relevant information.

[Your Name]

[Street Address]

[City, State Zip]

[Phone Number]

[Email]

[Date]

Subject: Section 609 of the Fair Credit Reporting Act

To whom it may concern,

I am pursuing my right to request information about item(s) listed on my credit report through the Fair Credit Reporting Act, Section 609.

[Give account names and numbers.]

Based on section 609, I am exercising my right to see the original source of information that contains the contract with my signature.

I’ve included these documents to verify my identity:

- Birth certificate

- Social security card

- Passport

- Driver’s license

- W-2

- Cell phone bill

You can also find an attached copy of my credit report with the portion that needs verification circled.

[If you have a lawyer, include this.] I have legal representation. Here is my lawyer’s contact information: [lawyer name, address, phone number]

The information should be removed from my credit report in the next 30 days if you cannot verify the original contract with a signature.

Sincerely,

[Signature]

[Full Name]

609 Credit Repair Expectations

Although there’s nothing wrong with exercising your rights under the FCRA, Section 609, or otherwise, you need to be realistic in your expectations.

Sending a letter to the credit bureaus may not solve all your credit problems, even if some negative accounts are removed from your credit reports.

Deletions or no deletions, chances are you may have some more work to do where your credit is concerned.

609 Dispute Letter FAQs

In this section, we will provide answers to some of the most commonly asked 609 dispute letter questions.

Q. How Long Does It Take for a 609 dispute Letter to Have an Effect?

When you ask for one of these marks to be removed, credit bureaus have 30 days to conduct an investigation.

You should receive the results within five business days after the investigation is finished.

Q. Does a 609 letter really work?

A 609 letter does work in 2022. Here are just a few people who have benefitted from a 609 dispute letter.

Will C. was able to raise his credit score by 200 points using the 609 repair strategy.

Brandon W. was able to remove 14 hard inquiries from his credit report.

Sandra was able to remove four of the seven hard inquiries from her credit report using a 609 letter.

Q. When should you write a 609 dispute letter?

The best time to write a 609 letter is when you believe there is an error in your credit report. A 609 credit repair letter will ask the credit bureau(s) to show proof of the information in your credit report, and you can get mistaken information off the report.

Q. What Can A 609 dispute Letter NOT Do?

A 609 letter is not a loophole.

You can’t remove any information that is harmful to your credit score on your credit report.

The letter simply requests credit bureaus remove inaccurate or unverifiable information.

609 Letter: The Importance of Credit Repair

Improving your credit with a 609 letter requires work, but the benefits you can cash in on once your credit is in good shape are well worth it.

Plus, writing a 609 letter depends upon your personal preference:

- you can use a free template or

- hire a credit professional

If it’s right for you, utilize the 609 letter to remove any unverifiable marks on your credit report and continue to practice healthy credit habits so that you can save money by qualifying for low-interest loans.