The Ultimate Goodwill Letter Template Pack

In This Article

- What Makes Up My Credit Score?

- What Is A Goodwill Letter?

- Do Goodwill Letters Work?

- Can Goodwill Letters Remove A Closed Account?

- The Impact of a Goodwill Letter on Your Credit Score

- How To Write A Goodwill Letter To Creditors

- Goodwill Letter Samples To Help You Draft Your Letter

- Goodwill Letter Vs Pay For Delete Letter

- Start Writing Your Goodwill Letters Now

- Continued Learning: Goodwill Letter

Did you ever miss a payment because of stress or circumstances out of your control, and now that late payment is hurting your credit score? There’s good news: you can ask your creditor to take the bad mark off your credit history with a goodwill letter. Here’s how.

If you have a late payment or other negative marks on your credit report that are dragging down your otherwise good credit score, there is a solution.

You can use a goodwill letter to fix your problem.

Yes, goodwill letters still work in 2022.

Similar to other aspects of improving your personal finances, the best part is that you can get started on it not just in 2022, but today.

In this article, we will explain:

- what a goodwill letter is

- how to use a goodwill letter to erase a late payment

- the impact of a goodwill letter on your credit score

- goodwill letter templates

- and more

If you're ready to discover everything you need to know about a goodwill letter, let's get started!

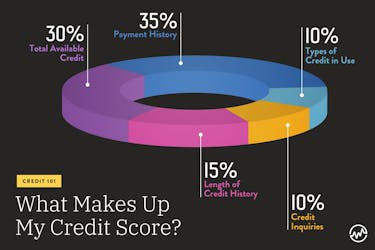

What Makes Up My Credit Score?

A late payment can do some serious damage when it comes time to apply for a new loan.

The reason payment history is so important is because it is the largest portion of most credit scoring formulas:

A late payment can damage your credit. What’s more, these derogatory marks can last on your credit score for 7-10 years.

But if you write what’s called a goodwill letter to the company that reported the late payment, you may be able to get them to remove the late payment on your credit reports.

That's how important a goodwill letter can be.

This could help raise your credit score and:

- help you get approved for loans you would have otherwise been denied for

- help you secure lower interest rates than you would have otherwise qualified for

That's the power of a goodwill letter: if successful, it can actually save you money.

What Is A Goodwill Letter?

A goodwill letter, sometimes called a forgiveness removal letter, is essentially a letter you write to your creditor that nicely asks for them to remove a negative mark from your credit reports.

Writing a goodwill letter to a creditor is fairly easy and is definitely something you can do for DIY credit repair.

While creditors don’t have to grant your request, writing a goodwill adjustment letter is simple and can’t hurt your credit.

Keep in mind, if there is an erroneous late payment on your credit report, you should dispute it, not write a goodwill letter.

You’ll have the best chance of getting a negative mark removed with a goodwill letter if you’re currently in good standing with your creditor.

It also helps to make timely payments for a long time after the missed payment.

If you make late payments on a regular basis, creditors likely won’t be willing to remove the black marks from your credit report.

Does this sound too good to be true?

It isn’t.

Do Goodwill Letters Work?

Yes, goodwill letters still work in 2022.

Many people have successfully had late payments and other issues removed from their credit reports even though they were reported properly by creditors.

For example, Brynne Conroy had a collection account of $10,000 college debt removed from her credit report after she had written a letter explaining her situation — and that she had paid off the debt as soon as she was aware of it.

“I explained to them what happened — that I was young and didn’t completely understand the process, and that as soon as I was aware of the debt I paid it off at a pretty fast clip,” she said. “I told them this is going to affect my ability to establish my own family.”

Many users on the MyFICO forums also report success getting negative information removed from their credit reports using goodwill letters with varying degrees of difficulty.

Here's another goodwill letter success story: one person had a 30-day late payment on an auto loan from FedChoice Federal Credit Union removed from their credit report.

Another person had three delinquent late payments from their Synchrony Bank account removed from their credit reports after months of contacting customer service.

Still need more proof that goodwill letters work?

Here’s an example of when a goodwill letter has worked for someone with 30, 60 and 90 days late payments on credit cards.

It’s important to understand that just because it’s worked for some people, writing goodwill letters won’t have a 100% success rate.

In fact, some creditors may refuse to make any changes based on your goodwill letter requests.

But writing a goodwill letter doesn’t take too much effort and has a potential for a huge payoff.

It can’t hurt your financial situation — but it can make it better.

Can Goodwill Letters Remove A Closed Account?

In addition to removing late payments, goodwill letters can be used in an attempt to remove a closed account.

Successfully getting closed accounts with negative payment history or collections activity removed from your credit report could potentially give your credit score a boost.

What if you don’t have any collections accounts or many missed payments?

In these cases, removing a closed account may not seem like a big deal, especially if you have a perfect on-time payment history for that account.

Be careful when asking to have closed accounts removed from your report — the removal may have unintended consequences.

Closed accounts factor into your credit score — as long as they’re on your credit report. In some cases, these closed accounts can actually lower your credit score.

In particular, closed accounts that weren’t established for long can drag down your average age of all of your credit accounts.

While this isn’t a huge portion of your credit score — this part represents only 15% — it’s important to take it into account.

After all, every point you can increase your credit score can help you get closer to getting approved for the loan you need.

The Impact of a Goodwill Letter on Your Credit Score

Before you sit down to compose a goodwill letter, you’ll probably wonder if it’s worth your time and effort.

Just how much can your credit score improve with a goodwill letter anyway?

Think about it.

While every late credit payment has a negative impact on your credit score, that impact varies based on when your payment was late, how late it was, and what your credit score is.

Your FICO score weighs recent credit activity most heavily.

This means if your late payment was made a long time ago, a goodwill letter will have less of an impact on your credit score than a payment you missed last month.

Additionally, credit reporting agencies pay attention to how many days your payment was late by.

Having a 60-day late payment “forgiven” is going to be more impactful than having a 30-day late payment removed.

Finally, your credit history itself matters.

Those with higher credit scores are penalized more severely for late payments — often experiencing 100-point drops for just one overdue payment.

By contrast, someone with poor credit may only experience a 50-point drop for a similar slip-up.

While there are a number of different factors that go into your credit score, most people can expect their credit score to increase somewhere between 60-110 points just by having one late payment redacted from their credit report.

With that in mind, the fifteen minutes it takes to compose a goodwill letter can be well worth your time and efforts.

How To Write A Goodwill Letter To Creditors

[ DOWNLOAD: Trying to get your credit fixed fast? Download our Ultimate Goodwill Letter Template Pack so you can get creditors on your side, and off your record. ]

When you sit down to write a letter to creditors to remove negative marks, it’s important to think about the person that will be reading your letter.

Would you want to be yelled at or accused of wrecking a person’s credit?

Rather than writing in an upset tone, do your best to write your goodwill forgiveness letter in a kind and respectful tone that would make a creditor want to forgive your past credit mistake.

When you write your letter, make sure you explain why they should remove your late payment from your credit reports.

If you simply made a mistake, such as falling behind on a student debt bill, let the creditor know.

Everyone makes an occasional mistake and the person reading your letter may sympathize with you.

Whatever you write, don’t make excuses. Own up to the mistake. Show responsibility for your actions, but blatantly and directly ask the creditor to remove the late payment from your credit report.

Keep in mind, people reading your goodwill forgiveness removal letter have a job to do.

While you want to get the creditor to sympathize with you and remove the black mark, they don’t have time to read long and detailed letters.

For that reason, respect the reader and keep your letter short and sweet.

You don’t need to write a multiple page letter to say “Sorry, I messed up”.

Instead, a couple of paragraphs with the following details will probably work best.

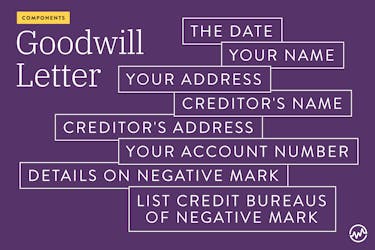

The following are important details to include in the goodwill letter:

- The date

- Your name

- Your address

- Your creditor’s name

- Your creditor’s address

- Your account number

- The negative mark you’d like removed

- Which credit bureaus the mark needs to be removed from

Goodwill Letter Samples To Help You Draft Your Letter

Here’s a sample goodwill letter asking a credit card company to remove a late payment from all three credit bureaus:

[Date]

[Creditor name]

[Creditor address]

Re: [Account number: XXXXXXXXX]

Dear [Creditor],

Thank you for taking a couple of minutes out of your busy day to read this letter. I’ve enjoyed my relationship with [Creditor name] since [Year account was opened].

I’m writing because I noticed your company reported a late payment in [Date of late payment] on my credit reports. I am requesting a goodwill adjustment to remove this late payment from my TransUnion, Experian and Equifax credit reports.

Upon review of my records, I realize that I did indeed miss the payment deadline. Unfortunately, [Explain why you missed the payment]. I take full responsibility for the mistake and have made sure it won’t happen again. As you can see from my payment history, I’ve made every payment on time both before and after the late payment.

I’m in the process of applying for a [Insert loan type here] and the negative impact of the late payment could result in a denial for my loan or a much higher interest rate that could cost me a significant amount of money. If you could make the goodwill adjustment requested, I believe it will significantly improve my chances of approval and save me unnecessary costs in the process.

Thank you for your time and consideration.

Sincerely,

[Your signature]

[Your printed name]

[Your address]

Keep in mind, you should change this goodwill letter example to meet your particular needs.

For instance, make sure to address the letter to a human by using a title of a position you think would read your letter, such as credit specialist, rather than to the impersonal “To whom it may concern”.

Copying and pasting a goodwill letter probably won’t work because the people that deal with these requests have probably seen almost every goodwill letter available on the internet.

Instead, be original for a better chance at getting your issue resolved.

If you’re having trouble figuring out where to send your goodwill letter, you can start with the correspondence address listed for the account on your credit report.

If you don’t get a response from the goodwill letter, try searching the creditor’s website for a correspondence address for the department your loan would belong to.

Here are a few more sample goodwill letters to remove charge offs:

Goodwill Letter Vs Pay For Delete Letter

Some often confuse a goodwill letter with a pay for delete letter.

While a goodwill letter is used to remove a debt you've already paid, a pay for delete letter is used to ask a creditor to remove a collection account or any other negative item from your credit report in exchange for paying either a portion of the balance or the full balance.

A pay for delete letter can be used when you owe a balance that cannot be disputed.

Start Writing Your Goodwill Letters Now

Writing a goodwill letter doesn’t guarantee a negative mark will be removed from your credit reports.

But it’s a simple exercise that doesn’t take much time and doesn’t have any major downsides.

What’s more — having a goodwill letter can raise your score by as much as 110 points.

This could help you save money on interest rates or get approved for a loan you’d otherwise be denied from taking out.

(Plus, make it a priority to pay off any credit card “bad debt” as fast as possible.)

Don’t put it off.

Start writing your goodwill letters today to fix your credit score fast.

Continued Learning: Goodwill Letter

Now that you know how to write a goodwill letter to improve your credit score, utilize these free resources to learn how to further boost your credit score:

- Learn how to master your personal finances step by step

- Discover how to improve your credit score in 30 days using these powerful tactics

- Find out what an authorized user is — and how it can help your credit score

- Here are 4 reasons you may not be aware of why your credit score dropped

- Learn how to get out of debt, boost your income, and start investing with this FREE online course