The DIY Debt Elimination Worksheet

In This Article

"Are there any organizations that help pay medical bills?"

When you’re facing a medical emergency, you’re focused on getting the help you need and improving your health — the last thing on your mind is how on earth you’re going to pay for it. When your medical issue is taken care of, the bills start to come. That’s when reality then sets in.

If the bill is more than your emergency fund and you don’t have a surplus of cash on hand, it turns into medical debt — 72 million people in America have this form of debt and need medical debt relief.

Racking up medical debt can happen in more ways and faster than you’d imagine. What can happen in a few seconds — a fall, a car accident, a sudden pain — can take years to repay.

It can take years to get your personal finances in order as well.

Thankfully, there are organizations that help pay medical bills if you’ve fallen into this challenging situation.

In this article, we'll explain each organization so that you can get the financial help you need paying your medical bills.

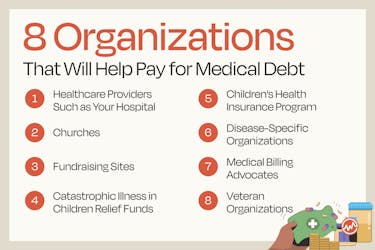

14 Organizations That Help Pay Medical Bills

If you’ve fallen into medical debt and need medical debt relief, consider the following organizations that help pay medical bills.

Option #1: Healthcare Providers Such as Your Hospital

Healthcare providers won’t pay your medical bills for you, but they do have the power to reduce or completely drop them.

If you’re having trouble paying your medical bills, call your healthcare provider. Be straightforward. Ask if they can reduce the bill or completely get rid of the bill.

If that doesn’t work, explain your financial situation. Then, ask if they have a department you could speak with that could help. Since some medical providers are non-profits, these providers may be able to help you with your medical debt in certain situations.

One example of this is National Jewish Healthcare, a nonprofit healthcare company. They offer financial help for health care services received at their locations.

You must meet requirements based on the following to qualify:

- Insurance coverage

- Income

- Family size

- Assets

- Other issues

If you can’t get your bill reduced or eliminated, ask about payment plans. Your provider may offer low or no interest payment plans, which can save you cash in the long run.

These can help providers obtain some of the money they’re owed and help you spread out the payments.

Option #2: Churches

If you’re facing a major medical emergency, it can’t hurt to ask your church for help. A church may be able to set up a fundraiser, which can help cover some or all of the cost of your medical bills.

If your church has a wide reach, the congregation could help rally the community behind your cause. A larger community can lead to more help to escape from your medical debt.

Option #3: Fundraising Sites

Your church isn’t your only option for fundraising to help pay medical bills. You can set up a fundraiser on sites such as GoFundMe.

There are many of these fundraising sites online, and you can find the one that best fits your needs. Remember that each site charges for their services in different ways.

No matter which platform you choose, you’ll need to get your story out there that way people can learn about your situation. Craft a sincere and compelling reason why they should donate—this can help your story stand out.

If you get enough people to help, it could cover a chunk or the entire cost of your medical debt.

Here are a few to consider.

Fundly

Fundly can be used to create and share online fundraising campaigns for individuals who need assistance paying their medical bills.

Users create a page with a photo or video gallery to promote their cause. Content from other social media platforms can be easily integrated.

The fees are straightforward: just 4.9 percent for each donation, and 2.9% plus .$.30 for credit cards.

Indiegogo

Indiegogo allows you to create a campaign centered around helping an individual who is experiencing a medical crisis and needs financial assistance.

Fees depend on whether users reach their campaign goal.

Givebutter

Givebutter, which allows you to create campaigns to assist others in paying their medical bills, allows users to easily track their progress towards their goal.

The thing that sets Givebutter apart is its fee structure. Donors have the option of “tipping” the platform to cover the fees, and if you elect to hide the tipping option, a standard fee applies.

FindHelp.Org

Findhelp.org is a free, online tool to connect people with the care and assistance they need — and yet another organization that helps pay medical bills.

It starts with simply inputting your zip code. From there, the site connects users with assistance in the most frequent areas of need including finding food, housing, healthcare.

The site has a dedicated section to connect people with thousands of resources to help them pay for their medical bills. Assistance comes from non-profits, corporations, or government programs.

Option #4: Catastrophic Illness in Children Relief Funds

Some states even offer Catastrophic Illness in Children Relief Funds. These include Arkansas, Massachusetts, New Jersey, and West Virginia.

Each state’s program may work differently. Check to see if your state offers a similar fund.

Option #5: Children’s Health Insurance Program

Many people are caught in a situation where they may be above the line that qualifies for Medicaid, but are still significantly challenged when it comes to purchasing health insurance for their children.

All 50 states administer their own Children’s Health Insurance Program (CHIP) according to federal guidelines.

More information on eligibility and benefits is available at Medicaid.gov.

Option #6: Disease-Specific Organizations

Some organizations offer help to pay medical bills that are related to specific illnesses. Here are a few examples.

The HealthWell Foundation

The HealthWell Foundation might be able to help you pay your medical bills. In particular, they provide financial assistance for the following:

- Prescription co-pays

- Health insurance premiums, deductible, and coinsurance

- Pediatric treatment costs

- Travel costs

To qualify, you need to:

- Receive treatment in the United States

- Have a household income of no more than 400 to 500 percent of the federal poverty level

- Have some form of health insurance

- Have an illness or disease covered by a HealthWell Disease Fund

- Have your medication be listed under the applicable HealthWell Disease Fund

The Leukemia & Lymphoma Society

The Leukemia & Lymphoma Society is an organization that helps pay medical bills. They can help with co-pay assistance for prescription drugs, travel assistance, and more.

They also offer resources that can help with your medical debt. Be sure to check out their free booklet about Cancer and Your Finances.

The PAN (Patient Access Network) Foundation

Another option for organizations that help pay medical bills: The PAN Foundation focuses on removing financial barriers to medications and treatments essential for care.

They offer nearly 70 programs tailored to specific diseases.

These programs can help pay for out-of-pocket costs, travel expenses, and health insurance premiums. Check out their list of programs on their website to see if they can help with your medical debt.

The CancerCare Co-Payment Assistance Foundation

The CancerCare Co-Payment Assistance Foundation aims to help people with cancer make their co-payments for chemotherapy and other targeted treatments.

They have a list of particular cancers they are accepting assistance applications for.

You can find out if you qualify after selecting a specific cancer diagnosis on their Covered Diagnoses chart.

They may not currently have funding for your specific cancer diagnosis. In this case, their co-payment specialists may be able to help.

They can provide information about other resources that may be able to help.

Option #7: Medical Billing Advocates

A recent report found 3 out four bills medical bills processed contain errors. Most often, patients are overcharged for services. Sometimes, the insurance billing code is incorrect, and more expensive than what was actually performed.

That’s where medical billing advocates come in.

Medical billing advocates won’t pay your medical bills for you, but they can help get your bills reduced.

These advocates know medical billing inside out. They can spot medical billing errors you might not catch yourself.

Additionally, they may know what billing items can be negotiated to lower prices than what you’ve been billed.

A billing advocate that reduces your medical bills essentially reduces your medical debt. Unfortunately, billing advocates often charge for their services, and sometimes, they can be expensive.

Option #8: VFW: Veterans of Foreign Wars

Another organization that helps pay medical bills, the VFW operates an “Unmet Needs” program to assist military families who are dealing with financial hardship due to military-related activity. The Unmet Needs grants are not loans and do not need to be repaid, which is welcome news for military families struggling with medical debt.

For more information on eligibility visit their website here.

3 Ways To Avoid Medical Debt

You can avoid wracking up medical debt — and avoid needing organizations to pay your medical bills — in three ways:

- Maintain Health Insurance

- Avoid Emergency Room Visits

- Prevent Hospitalization

We’ll explore each one in-depth next.

#1: Maintain Health Insurance

One of the quickest ways to rack up medical debt is to have no health insurance, which covers you in the event of a medical need.

Although there is no longer a federal penalty for not having insurance, you run the risk of being on the hook for any sudden or planned medical needs, which can be hundreds of thousands of dollars.

After all, accidents aren’t planned.

Even though many providers offer self-pay discounts, which can reduce the outrageous initial price tag of medical bills but may still leave you with a hefty bill you can’t afford to pay, there are little to no pros when weighing whether or not you should have health insurance.

Saving money each month by not paying for health insurance won’t equate to more than the thousands of dollars that health emergencies can cost.

If you currently don’t have health insurance, here are a few options so that you can obtain coverage.

COBRA

If you have been recently unemployed, The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that allows you to stay on your employee health insurance after your job ends, usually for 18 months — if you pay the full premium yourself.

For more information on COBRA, click here.

Medicaid

A program funded by the states and the federal government, Medicaid provides health coverage to low-income adults, children, pregnant women, elderly adults and people with disabilities.

To find out if you’re eligible, you’ll need to provide:

- How many people are in your household?

- What state do you live in?

- What is your estimated income for 2020?

To find out if you are eligible, click here.

Marketplace Health Insurance

You can purchase affordable insurance on the government-provided marketplace.

To explore this option, visit HealthCare.Gov.

Private Health Care Plans

You also have the option to purchase private health insurance directly from an insurer in your area.

Not only will having health insurance financially protect you in the event of an emergency or accident — you can rest easy and stress less knowing that you won’t have to foot an enormous bill because of an unforeseen circumstance.

Medicare Part D

Medicare Part D, also known as the “Extra Help” program, can help with some of the extra costs that come with Medicare prescription drug programs.

You can find out more about “Extra Help” eligibility and benefits by contacting your Medicare drug plan administrator.

Supplemental Security Income

The Supplemental Security Income program was created to assist those on limited incomes who are over 65, disabled or blind.

The benefits are not tied to your work history. You’ll receive a monthly benefit check for a fixed amount. The amount paid by the federal government is the same nationwide, but some states may add an additional amount.

You can use this benefit towards any expense you wish, including helping to pay your medical bills.

#2: Avoid the Emergency Room

A hospital’s emergency room or department is intended for serious problems that need immediate attention. These are problems like:

- severe cuts and bleeding

- broken bones

- heart attacks

- strokes

- severe trauma

Many people visit emergency rooms for problems that might be able to wait until a regular doctor’s appointment or a visit to an Urgent Care clinic.

Emergency room visits average $1200 and are often much more expensive.

Urgent care visits, while still more expensive than a regular office visit are usually between $100 and $200. These clinics usually have extended hours and allow walk-in care.

If you’re visiting for a true emergency, lab tests or other procedures may have to be done. These add even more costs.

It’s not uncommon to leave the emergency room and then get hit with many bills in the thousands of dollars — and need medical debt relief.

If your medical situation isn’t critical, visit a general doctor or an urgent clinic. Doing so may take more time before you can see a doctor, but both of these options will be far cheaper in the long run.

Hospitalization

If you end up getting admitted to the hospital for any reason, your bill will skyrocket. Then, you may need medical debt relief.

Everything is vastly more expensive in the hospital — a study found these alarming costs:

- Tylenol billed as $15 per individual pill (a supply of 50 tablets costs $13)

- a medicine cup billed as $10 (medicine cups can be bought for under $5.00)

- a bag to hold your personal items — like a grocery bag — cost upwards of $8 (plastic bags can be purchased for 2-5 cents)

Hospitals charge daily rates for use of a room, too. These rates blow almost any nightly hotel rate out of the water.

Then, add in costs for supplies, medications, lab work, and doctor consultations — you’re already in the tens of thousands of dollars, if not more.

It’s easy to see how you could end up in medical debt quickly.

Do Medical Bills Affect Your Credit?

While most healthcare providers don’t report medical debt to the three nationwide credit bureaus (Equifax, Experian and TransUnion), they reserve the right to give your overdue account to a collection agency after a 6 month period.

Why the extended period?

Because medical expenses are often so unexpected, all the parties involved in billing give people a little more leeway before it impacts their credit.

If you accrue medical debt, use the extended time wisely, and begin using all available resources to pay your medical bills before they have a chance to negatively impact your credit score.

The Bottom Line: Organizations That Help Pay Medical Bills

Now that you’re aware of some of these organizations that help pay medical bills, it’s time to take action and get medical debt relief.

Reach out to the organizations that could help you with your specific situation. Follow up to make sure you’ve provided all of the necessary information to request help.

Also, ensure that you are putting your health first to avoid future medical issues that may require thousands of dollars in bills.

Remember in the future that if your medical condition isn’t critical, you do have options when it comes to seeking treatment.

If a hospital stay is unavoidable though, remember that you do have options — such as these organizations that help pay medical bills — with helping to pay off medical debt.