Get Access to 250+ Online Classes

Learn directly from the world’s top investors & entrepreneurs.

Get Started NowIn This Article

You may face a tough reality when it comes to paying for the constantly increasing costs of a college degree. Your parents might not be able to afford your college education without taking on debt themselves, delaying their retirement or having you take out student loan debt. This challenging truth may leave you taking out way too much student loan debt for a degree that might not pay off.

In some cases, ANY student loan debt is too much debt.

That said, sometimes it’s a smart move to take out student loan debt if you have to so you can invest in your future.

But how do you know how much is too much student loan debt?

College Should Be Viewed as an Investment

You might accept attending college as a fact of life. You’re supposed to pick a school, pick a degree, then worry about how it will all work out after the fact. It shouldn’t be this way.

Instead, college should be viewed as an investment — not something to do simply because everyone else is doing it.

Viewing college as an investment can be difficult as you have to make certain assumptions. However, proper research can prepare you to make an educated decision.

First, you need to figure out what type of job you want after college. Next, research average starting salaries for the position in the part of the country you want to live in. Finally, research the cost of college degree programs that can get you the job.

When researching the above information and assigning numbers to these variables, you need to be realistic — don’t assume you’re going to get the best job with a crazy high salary right out of college.

Instead, focus on average numbers or even consider reducing your potential pay in case the economy crashes or you aren’t able to land the job you really want right away. Based on all of this information, you can see the return you’ll get on your investment.

It will be immediately obvious taking out $150,000 of student loan debt to get a $35,000 job isn’t worth it. At the same time, it will be clear taking out $25,000 of student loan debt to get a $70,000 job out of college is a smart move.

Because taking on debt is a mindset based on an immediate need, it’s important to keep in mind that every penny you borrow, you will have to re-pay. That’s why it’s critical to keep your student debt and therefore your monthly payments as low as possible.

Here’s What Your Monthly Student Loan Payments Could Look Like

You may not realize you’ve taken out too much student loan debt until it’s too late. When you’re taking out loans, you probably won’t think to calculate how much your monthly payment on your debt will be after you graduate.

You can avoid this fate if you’re still in college or you haven’t started college yet.

First, determine the cost of the college you want to attend and then calculate the amount of student loans you’ll need to take out in order to earn your degree.

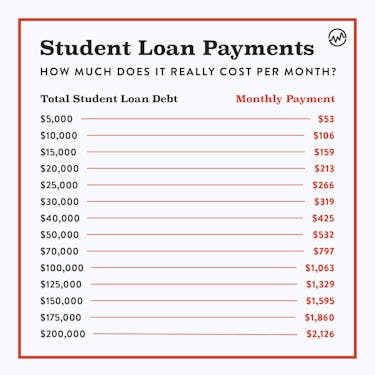

Then, add any interest you’ll accumulate while in school. After that, compare the total amount of student loan debt you’ll have at the beginning of your repayment period to the table below to get an idea of how much your monthly student loan payments will be.

Here are some examples to drive home exactly how much your student loan debt could cost you on a monthly basis if you only make the minimum payments.

For these examples, we assumed the standard repayment plan of 10 years and a fixed interest rate of 5.05% for simplicity’s sake.

The amounts of student loan debt listed are the amount owed at the beginning of the repayment period.

If your interest rate or loan amount differs from the calculations above, insert the numbers for your situation into a loan calculator to get a customized result.

The RULE: How to Tell If a College Degree Is Worth It

So how do you tell how much is too much student loan debt for you?

The rule of thumb is your student loan debt should not exceed your starting salary out of college.

But rules of thumb don’t always work for every situation. It wouldn’t make sense to take out $30,000 of student loan debt . . . to get a $30,000 job you could get without a degree.

Instead, you need to look at your situation objectively and determine what makes sense for you.

In particular, you need to consider how much you can afford for a student loan payment on your expected post-college salary.

Let’s say you currently have the opportunity to skip college and start a job that has a $35,000 annual salary. Your alternative is attending school, taking out $50,000 of student loan debt, and starting a $50,000 job after you graduate.

You’ll earn an additional $1,250 per month by attending college (before taxes) and approximately $532 of your extra income will go toward paying off your student loan debt. In this case, going to college makes sense.

It makes even more sense when you realize a larger starting salary will result in larger raises over your career, assuming the same percentage raise in each case.

After 20 years of 3% raises, a $35,000 salary would turn into $63,214 while a $50,000 salary would turn into $90,306.

Even though this rule of thumb isn’t perfect, don’t use it as an excuse to attend college at any cost.

An increase in your salary that just barely matches the amount of your student loan payments isn’t enough to make attending college worthwhile.

While your income will increase, you still have to pay Social Security tax (6.2%), Medicare tax (1.45%) as well as federal, state and potentially even local income taxes on your extra earnings.

If your salary increases by $500 per month and you have to make $500 in student loan payments, you won’t have enough extra money to pay for your student loan payments even with your additional earnings due to the extra taxes you have to pay.

You Can Still Graduate Without Student Loan Debt

But what if any student loan debt is too much debt for you to stomach?

Believe it or not, it’s totally possible to graduate with zero student debt. It’s not easy, but it can be done if you’re diligent, willing to explore your opportunities and you carefully plan your college education.

1. Scholarships

Want free money to attend school? Look for scholarships.

You can find a crazy amount of free money in scholarships that companies, scholarship committees, and schools want to give to you.

While you probably won’t win every scholarship you apply for, the awards you do win can be large enough to make applying for multiple scholarships worth your time.

2. Working a Job Can Help in Many Ways

Scholarships alone may not pay your way through college. In these cases, it never hurts to work a job to earn money to pay for college.

Some jobs may even offer employer assistance to help pay for your degree in addition to the wages you earn at work.

3. Stretch Out Your Schooling

While it’d be nice to wrap up your degree as fast as possible, you could stretch out your attendance and take a few credit hours each semester as you can afford them.

Spreading out the cost over a longer period of time gives you more time to work for the money you need to pay for your degree without debt.

4. Live at Home

Don’t rule out living at home while you attend college.

Living at home isn’t the traditional college experience, but it can save you a big chunk of money you’d otherwise have to pay for rent or room and board at a school away from home.

5. Consider Cheaper Schools

Finally, don’t rule out cheaper colleges because they aren’t your dream school. It’d be nice if everyone could attend the school they wanted to, but sometimes the value of earning a degree isn’t worth the additional cost.

It may even make sense to attend community college then transfer those credits to a four year degree program to save money on your overall cost of college.

College Is a Choice — Don’t Make a Stupid Money Move

Despite what your parents may have driven into your head, college is not something everyone has to do.

In fact, you may be better off attending a trade school you’re interested in than trying to obtain a traditional four-year college degree.

This is especially true if you’d have to take out too much student loan debt and you won’t receive a big benefit from the degree.

Take an objective look at your financial situation with and without the degree you’re considering, along with the amount of student loan debt you’d have to take out to make the degree a reality.

Then, decide if the cost of college is worth the student loan debt you’d have to take out. By doing this, you can save yourself from the shackles of student debt.